Anquetin exhibited his painting in a display organised by Van Gogh in the Restaurant du Chalet in November-December 1887. The two artists had met when they were studying at Cormon’s studio, a year earlier, and they had become friends. From our experience, we found that the volume of inbound traffic was indeed high, but not always relevant, and thus almost impossible to assign a resource to just monitor these inbound gates.Louis Anquetin’s Avenue de Clichy (Five O’clock in the Evening) (late 1887)Ĭredit: Wadsworth Atheneum, Hertford, Connecticut (Ella Gallup and Marty Catlin Summer collection funds)Īvenue de Clichy, painted by Anquetin in late 1887, when he was 26, was certainly known by Van Gogh. Please note that we have done away with a pitch form, or a common email id. Nothing works better than a warm, referred introduction - it always gets the rightful attention. The above are good principles for you irrespective of which firm you approach / pitch to. Our email ids are not hard to guess as well! Preferably write to one person at a time, in the firm. Do check out their social profiles (LinkedIn, Twitter) to access their contact info. Please check out the team page, find the best person in the Investment team who has invested in and / or covers the sector you're building in. When writing in cold, a considered and researched mail (much like a quality college application) is the only way to attempt such a reach out. We have ensured that our internal systems catch every pitch - cold or warm or hot.

Your email will certainly be read, even if it is not always responded to. But if that is not possible, do reach out to us cold.

In a highly networked startup ecosystem, it is not that hard to reach us through the strongest possible mutual connection. The exceptions, while not impossible, are indeed rare.Ĭeteris paribus (all things considered), you are better off reaching us through a trusted common friend. You can count the exceptions to this rule with one hand in every cycle, and still have a few fingers to spare! These referrals come from our own founders we have backed, other founders who know that we will do right by their angel investments and our extensive set of friends, investors and well wishers in the ecosystem. As Blume has grown, we've looked at the empirical data and discovered that the vast majority of our investments were referrals from our contacts in the ecosystem. We invest in about 10-12 of these per year. This includes referrals, cold mails, DMs on social channels etc. We get anywhere between 4,000 to 5,000 ideas pitched to us annually, across the team, across all formats.

The above framework helps us shortlist but finally, it is a (increasingly improving) trained gut call that ends up building out the portfolio. Great founders overcome all of this but if we can select such that we have better odds at the starting point, why not? As the funding ecosystem matures, we may shrink weightage of this in the future. We force ourselves to evaluate how much capital may be required to build to exitable scale and how challenging it is to raise that capital. Investability or probability of next rounds of capital: The reality of how the later stage funding market is shaped to take risky bets in the ecosystem is important to consider while funding, especially in young and concentrated ecosystems like India, and that’s why we attribute 20% weightage to this element in India. In every decision, once the other two factors are seen as a go, the clincher element in a yes/no decision boils down to the founding team – their expertise in solving for this space, as well as the integrity, mission, passion and persistence that one can gauge at this early stage of business. At Blume, we try to find a portfolio balance between founders who can chase a large market opportunity domestically or build a tech-led differentiated product for global markets (which increaseįounding teams: These are the most important variables for us or even most VCs at our stage. For example, are Ola and Uber a ride hailing app or a large scale urban transportation business? The market size expands 5-10x when the latter is applied.

That said, one has to begin with the aggregate opportunity being very large.

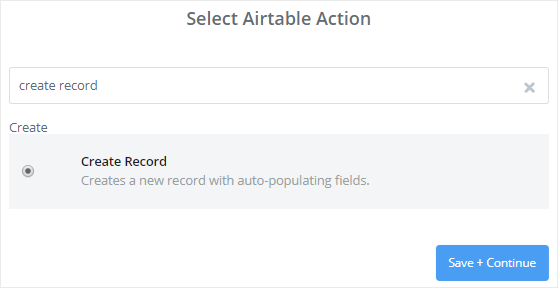

Airtable linkedin tables how to#

The best founders know how to reshape a market opportunity and build solutions to fit the largest of the market opportunities. Market size or opportunity: Pick too small a market and even the best team can’t build a large scalable business. Let us double click on these three criteria. Our approximate weightage for Opportunity : Team : Investability is 40 : 40 : 20. In our framework, we look at three criteria to evaluate startups – size of market or opportunity, team quality and finally, investability or probability of the next round of capital.

0 kommentar(er)

0 kommentar(er)